- Acquisition Ace

- Posts

- How an Army vet and his wife bought an upscale nail salon for $675K

How an Army vet and his wife bought an upscale nail salon for $675K

150% ROI in year one on this upscale St. Louis business

Ben spent 10 years in the Army before realizing he didn’t want to do the full 20.

His wife Andrea had run a small marketing business but wanted something more scalable.

They both knew they wanted to work for themselves, but not as sole proprietors starting from scratch…

And after joining Acquisition Ace and putting in the work, they closed on a $675K upscale nail salon in St. Louis.

Here’s how it happened 👇

Finding the Deal

Ben and Andrea spent months building relationships with brokers while searching on BizBuySell.

They initially looked at the nail salon in January but passed (the multiple was too high at 4.2x SDE).

Five months later, the broker called back. The price had dropped significantly, and the seller was motivated.

The business stood out because it was simple:

Four core services

Upscale clientele

Non-toxic products

And W2 employees (not 1099 contractors)

The previous owner had built a seven-year reputation for high quality and efficiency in one of St. Louis’s wealthiest suburbs.

(Building broker relationships can unlock deals that never hit public listings. Inside Acquisition Ace, members learn the ins and outs of networking, deal-making, and acquiring your first business. If that sounds interesting, book a call with our team here to learn more.)

The Deal Breakdown

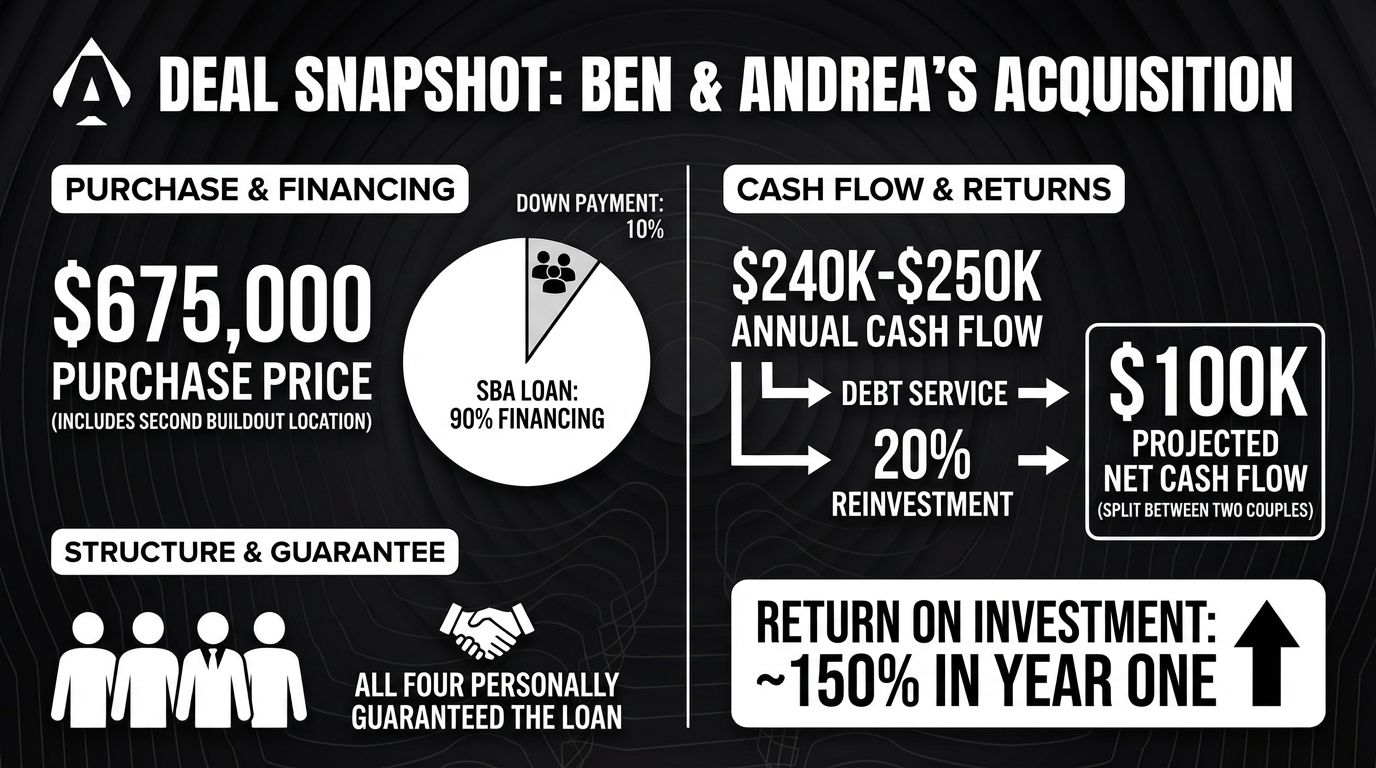

Purchase price: $675,000 (included a second buildout location)

Cash flow: $240K-$250K annually

SBA loan: 90% financing

Down payment: 10% split between two couples (Ben & Andrea plus an Army buddy and his wife)

Structure: All four personally guaranteed the loan

After debt service and setting aside 20% for reinvestment, they’re projecting $100K in cash flow, split between the two couples.

That’s about a 150% return on their initial investment in year one.

What They’re Doing Now

Ben and Andrea moved from Boone, North Carolina to St. Louis a week before closing to run the business hands-on.

Their plan:

Stabilize operations

Build systems

Hire a GM

Step away to pursue their next acquisition

Andrea is creating process videos for every task (morning setup, laundry, closing procedures) so anyone can scan a QR code and know exactly what to do.

Ben is focused on adding revenue streams, as the previous owner did zero marketing and sold no products despite having a loyal, high-spending customer base.

They’re also solving retention challenges (some new hires ghost after day one) by building team culture and creating incentive programs.

Their Key Lesson

“Don’t accept a bad deal just because you think you’re waiting too long. But also understand there’s no perfect deal.”

Ben and Andrea spent months looking before finding the right fit, and they still had to compromise on some things.

The key is knowing your non-negotiables and being flexible on everything else.

Ready to close your first deal?

Join the Acquisition Ace community with 2,000+ members who are learning to find, finance, and close deals just like Ben and Andrea.

👉 To see if the community is right for you, book a call with our team here.

Onward,

— Ben Kelly

| Onward, Ben Kelly PS: Check out our latest YouTube video. We reveal the 7 levels of profitable boring businesses and how to climb them. |