- Acquisition Ace

- Posts

- 5 due diligence steps that save deals (and prevent disasters)

5 due diligence steps that save deals (and prevent disasters)

Skip these and you’re gambling with your money

One of the biggest mistakes first-time buyers make is not doing thorough due diligence.

I’ve seen people fall in love with a business based on surface-level numbers, skip the hard questions, and end up with a disaster on their hands.

Today, I’ll share the five critical due diligence steps that separate smart buyers from reckless ones.

1. Calculate true owner benefit (SDE)

Don’t just look at what the P&L says the business makes.

Instead, calculate Seller’s Discretionary Earnings (SDE) - the total financial benefit flowing to the owner.

This includes their salary, distributions, AND personal expenses the business covers (car payments, insurance, travel, phone bills).

Many sellers hide profit this way to reduce taxes, so you need the full picture of what you’ll actually take home.

2. Verify the profit margin sweet spot

Target businesses with 15-35% profit margins.

Below 15%?

One major hit (losing a big client, an unexpected expense) could put you in the red.

Above 35%?

The owner is probably doing all the work themselves, which means you’re actually buying a full-time job.

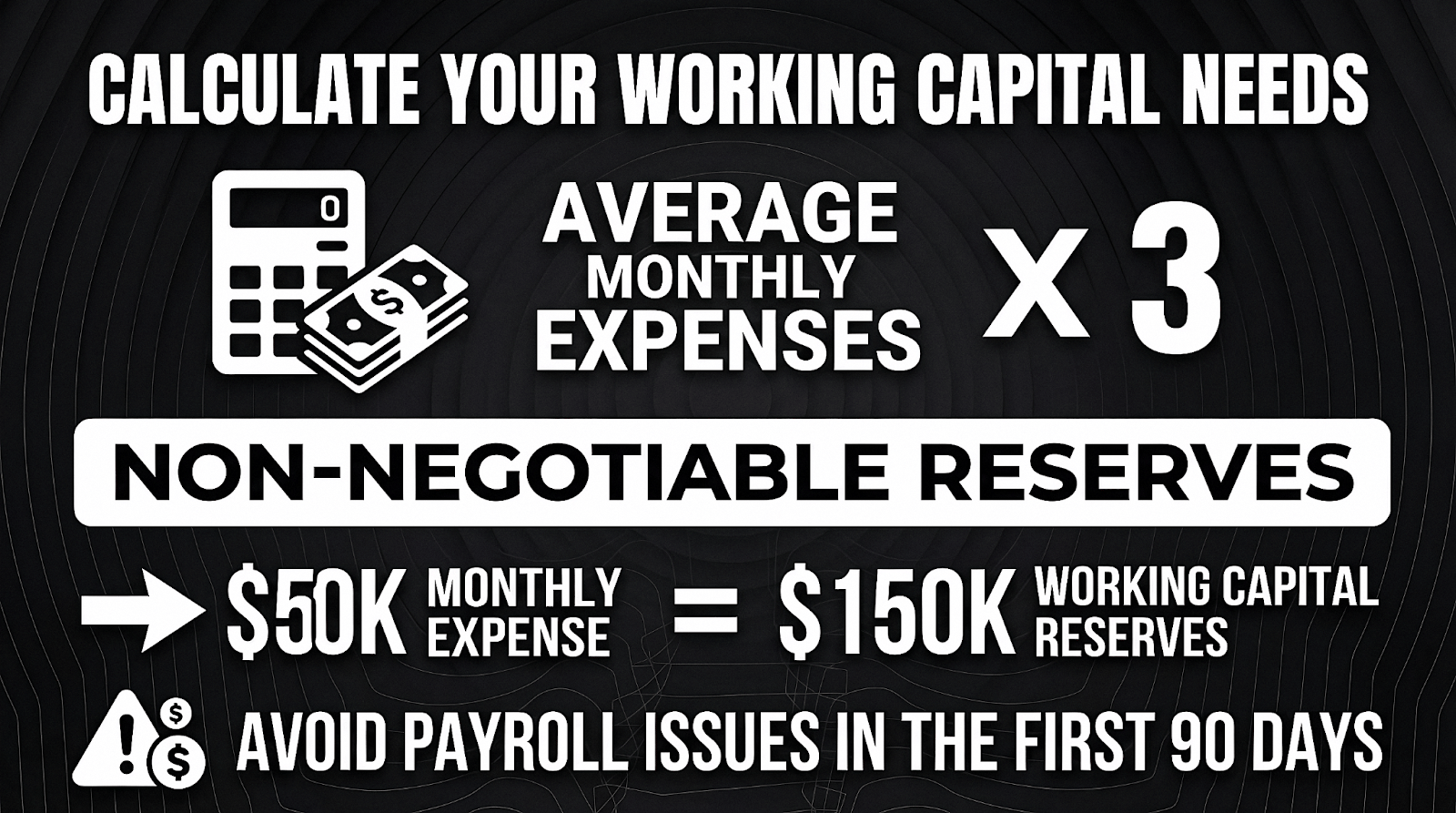

3. Calculate your working capital needs

Here’s the formula:

Take average monthly expenses, and multiply that total by 3.

If the business spends $50K per month, you need $150K in working capital reserves (via line of credit or SBA loan).

This is non-negotiable.

I’ve seen buyers skimp on working capital and end up scrambling to make payroll within their first 90 days.

(Inside the Acquisition Ace community, members get access to professional SBA loan bankers and investors who help structure financing the right way from the start. Want to see if you’re a fit? You can book a call with our team here.)

4. Evaluate the management structure

Your most important asset is the people you acquire with the business.

Ask these questions:

How many hours does the owner work per week?

Is there a GM handling daily operations?

What’s the average employee tenure?

Who does what, and for how long?

If there’s no GM and employees are constantly leaving, you’ll be stuck managing everything yourself from day one.

5. Understand their systems and processes

Dig into their operations:

What software and CRMs do they use?

How do they acquire customers (active marketing or just referrals)?

Are there documented procedures for key tasks?

If everything runs on outdated systems or lives in the owner’s head, factor in the time and cost to fix that after you take over.

An important message for future business owners

Buying a business isn’t a magic shortcut to wealth.

It takes a lot of hard work, and doing proper due diligence before you even get started.

But if you’re willing to do the research and ask hard questions, you can build serious financial freedom while avoiding expensive mistakes.

And if you want to shorten your learning curve, the Acquisition Ace community could be the missing piece you’ve been looking for.

You’ll get access to step-by-step frameworks, professional SBA loan bankers, and a network of 2,000+ buyers who can help you avoid expensive mistakes.

If that’s something you’d be interested in…

👉 Book a call here with our team to see if the Acquisition Ace community is right for you.

Onward,

— Ben Kelly