- Acquisition Ace

- Posts

- 3 ways to buy a business without draining your savings

3 ways to buy a business without draining your savings

You don’t need to be rich to buy a business

Many prospective business owners think you need hundreds of thousands in cash to buy a business.

Fortunately, that’s just not true!

Regular people with W2 jobs are closing deals every month using creative financing that requires little to no money down.

Today, I’ll reveal the three most common methods and when to use each one.

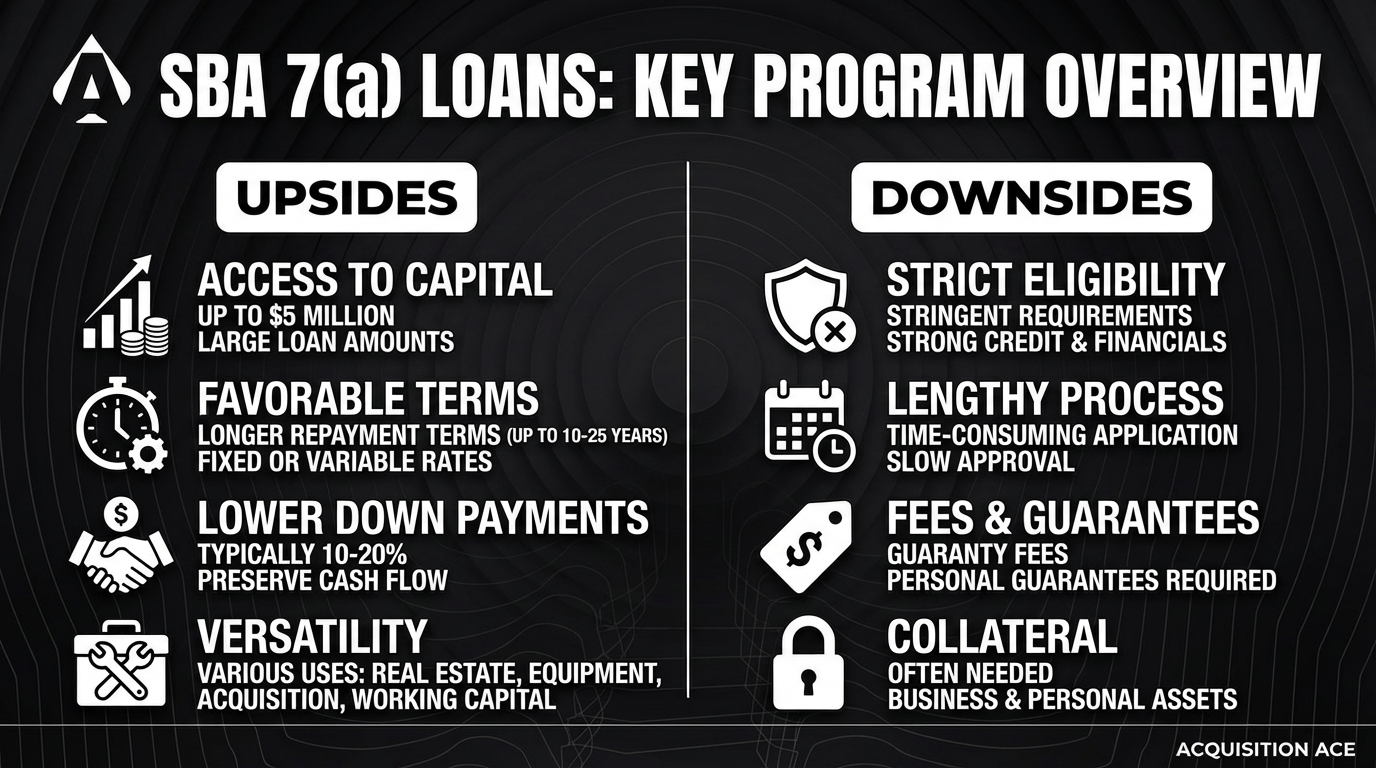

SBA 7(a) Loans

This government-backed program was literally designed to help people buy businesses with minimal capital.

The upside:

Banks will finance up to 90% of the purchase price, meaning you only need 10% down.

And if you structure it correctly with seller financing, you can reduce your out-of-pocket to zero while maintaining full ownership.

The downside:

You need decent credit (typically 680+), collateral, and a track record that shows the bank you’re capable of running the business.

If things go south, the SBA lender can pursue your personal assets for repayment.

Raising Capital from Investors

This is where you bring in partners or investors to fund part (or all) of the deal.

The upside:

You spread the financial risk across multiple people.

Investors often bring valuable expertise, connections, and resources beyond just money.

You can raise more capital than the other methods, giving you extra working capital to grow the business.

The downside:

You’re giving up equity, profit share, and some decision-making control.

Investors expect returns, which adds pressure to perform quickly.

(Inside Acquisition Ace, members learn exactly how to structure investor partnerships and connect with people actively looking to invest in deals. If you’d like to learn more, book a call with our team here.)

Seller Financing

This is where the seller essentially acts as the bank and finances part of the purchase.

The upside:

The seller has skin in the game, so they’re motivated to ensure a smooth transition and help you succeed.

This typically requires the least cash (or none) compared to other methods.

The downside:

Most sellers prefer getting paid in full at closing, so finding someone willing to finance takes more time and negotiation skills.

Which method is right for you?

Most successful deals combine multiple methods.

For example: 85% SBA loan + 10% seller financing + 5% your own cash.

The key is understanding how to structure creative deals that work for both you and the seller.

If you want to learn how to find, finance, and close deals with minimal capital in the Acquisition Ace community (with 2,000+ other members)…

👉 Book a call with my team to see if you’d be a good fit.

Onward,

— Ben Kelly

| Onward, Ben Kelly PS: Check out our latest YouTube video. We break down how boring businesses are making people millions. |